IRS Tips For Giving to Charity

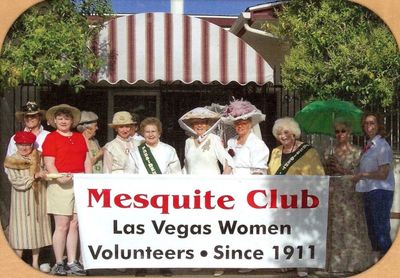

Support the Mesquite Club with a tax-deductible donation!

Mesquite Club, Inc. is a qualified 501(c)(3) charitable organization (EIN 88-6003112). Your gift helps fund community service, scholarships, and the care of our historic clubhouse.

Ways to give: cash, check, credit/debit card, electronic transfer, and approved in-kind donations (household goods in good used condition).

Tax receipt: Please keep your bank record, and request an acknowledgment for donations of $250+ for your records.

Thank you for helping us continue our mission of service in Las Vegas.

Remember the Mesquite Club in Your Will

Your attorney will be able to explain the tax advantages to you of making bequests to The Mesquite Club, Inc. In terms of actual costs to your estate, the deductibility of such bequests for Federal estate tax purposes mean that the actual dollar outlay may be far less than the face amount of the bequest. This is particularly true if you are a person of considerable means. Your attorney can acquaint you, in an approximate way, with the actual savings you may envision for your estate by means of such bequest. You need not make the bequest in outright form, but you may plan them so That they will take effect only upon the death of other members of your family for whom you have made prior provisions in your will. In this way, you may accomplish the two-fold result of providing security for your closest loved ones while seeing to it that, when the funds are no longer needed for their support, the funds will be put to constructive use.

Your bequests can take the form of furthering the general purposes of The Mesquite Club, Inc. or, if you wish, or can be earmarked for some particular phase of The Mesquite Club, Inc. activities that specifically Interest you. Although The Mesquite Club, Inc., will welcome and be grateful for such bequests for specific purposes, The Mesquite Club, Inc., prefers that bequests not be restricted., so that after your death, the money can be used for whatever programs are then in need of funds.

If you are thinking of making a bequest to The Mesquite Club, Inc., you should explore this matter fully with your attorney. They will be able to assist you in effectuating a plan which will best achieve your particular testamentary objectives. For the guidance of attorneys drafting wills which make bequests to The Mesquite Club, Inc., there are shown below a few samples of the different forms such bequests may take. Of course, these forms must be adapted by the attorney who makes use of them to the requirements of the particular instrument that they are drafting. They must be aware of the interrelationships between such bequests and the other provisions of your will.